Summer 2014

President’s Message

Forms

Legislative Update: 2014 Legislative Session

Annual Convention

North Carolina/South Carolina Border Discussion

Lien Rights Against Tenants: Pete Wall Plumbing Looking to Cause Flood of Problems

Criminal Tactic: Fradulent Change of Business Registration

Welcome to our New Executive Director

From the Editor

.jpg) This will be my last message to you as President of the Association. It has been my pleasure to serve and the eventful year has gone by quickly! Lisa Shields-Cook will take the reins at our Annual Convention in September in beautiful downtown Charleston, SC. We hope that we will get to see many of you there and to celebrate together some of our Association’s accomplishments!

This will be my last message to you as President of the Association. It has been my pleasure to serve and the eventful year has gone by quickly! Lisa Shields-Cook will take the reins at our Annual Convention in September in beautiful downtown Charleston, SC. We hope that we will get to see many of you there and to celebrate together some of our Association’s accomplishments!

As many of you may know by now, Nicole Shore resigned as her position with NCLTA and with FirstPoint to take a position in Winston-Salem with RJR. Her resignation came as a surprise to us all but we wish her the best in her new endeavors and thank her for her hard work on behalf of NCLTA over the years. I am pleased, however, to welcome Anita Turlington as our new Executive Director. Anita is an ECU alumna and comes to us from a large medical association where she had excellent experience performing many of the functions that we ask of our director. She brings with her a great deal of energy and some new ideas that I hope we can put to good use. Please make a point to contact Anita and to welcome her to NCLTA. She can be reached at aturlington@FirstPointResources.com and she will be in attendance at the Annual Convention in September!

Nick Long and David Ferrell have had a busy time this summer at the General Assembly. In a short session that is typically concerned with the budget and non-controversial housekeeping measures, the General Assembly considered a number of measures that were concerning to our group. It appears that we were able to maintain the status quo with regard to a number of proposals which we oppose. We will need to remain vigilant in the 2015 long session where many of these controversial matters may reappear. I am pleased to report that our proposal to clarify how a Notice to Lien Agent must be given (revising GS44A-11.2) has made it out of the General Assembly and, at the time of this writing, awaits Governor McCrory’s signature. I cannot overstate the value that David and Nick added to the process of shepherding that proposal through. Be sure to read the Legislative Report for all of the details!

The NC/SC Boundary Commission has made its recommendations to the General Assembly for addressing the myriad of issues that resetting the boundary between North and South Carolina creates. NCLTA took a lead role in organizing a task force to consider the implications to real property which are many. Chris Burti and John McLean played key roles in drafting a legislative proposal that was approved by our task force and submitted to the Boundary Commission for inclusion in its recommendation to the General Assembly. We expect to see more about this issue as the General Assembly begins to grapple with it in 2015.

We look forward each year to our Annual Convention on September 11-13 at the Renaissance Hotel in downtown Charleston. We already have a strong attendance and encourage those of you who have not signed up to do so quickly. Details about the convention are available on our website at http://www.nclta.org/2014Convention. Consider signing up for the carriage tour and harbor tour! Charleston is an historic and interesting city and the tours are a great way to get a feel for the place.

As we have for the last couple of years, we will be raising funds for the NCLTA PAC at the annual convention. There will be exciting raffle items and the opportunity to make donations at registration and throughout the weekend. The NCLTA PAC has proven to be a very useful tool as part of our Association’s advocacy. Please give and give often in support of our industry in North Carolina!

See you in Charleston!

Regards,

Jay

Legislative Update: 2014 Legislative Session

On Wednesday August 20, 2014, the “short” session of the North Carolina General Assembly ended for the year. There was some discussion that the legislature would come back in November 2014 to address Medicaid reform. But ultimately the legislature adjourned sine die for the year.

The session, which was first projected to end by July 4, became protracted due to disagreements over the state budget bill, a coal ash clean-up bill, Medicaid reform, economic incentives, and other issues. The primary focus of the session was adjusting the state’s budget. On August 2, 2014, the legislature passed the $21 billion state budget bill. The budget bill was signed by Governor McCrory on August 7, 2014.

The legislature passed 572 new laws during the two-year session, and met for 162 legislative days on the House side and 163 legislative days for the Senate. The legislature passed a number of significant pieces of legislation this session, including a coal ash clean-up bill, a bill to increase teacher pay, and regulatory reform. The legislature was not able to reach an agreement and enact bills to reform Medicaid, expand insurance coverage to cover autism, or extend tax incentives to film companies.

The legislature enacted several bills that affect the legal profession generally, including a bill to make various changes to North Carolina’s Business Court (Senate Bill 853) and a bill to provide for legislative confirmation for special superior court judge appointments (Section 18B.6 of the State Budget Bill, Senate Bill 744).

Of interest to NCLTA, the legislature passed our top legislative priority in 2014, a bill to make technical corrections to the notice to lien agent form, used in the lien agent process (House Bill 1133).

The 2015 “long session” is scheduled to begin on Wednesday January 14, 2015. The legislature did not adopt a studies bill this session. Although the President Pro Tem of the Senate and Speaker of the House have the inherent authority, including through the Legislative Research Commission and Courts Commission, to study issues, it is unclear at this point whether there will be any formal studies before the 2015 legislative session convenes.

This article contains a summary of the legislation of interest from the 2014 Legislative Session. For more information about legislation described in this article, feel free to contact me at dferrell@vanblk.com or (919) 754-1171. Information is also available on the General Assembly’s website: www.ncga.state.nc.us.

Mechanic’s Lien Legislation

Two (2) bills were considered this session that originated from the House-only LRC Committee on Mechanics Liens and Leasehold Improvements that met before this legislative session: House Bill 1101, Mechanics Liens - Leased Public Property, and House Bill 1102, Mechanics Liens - Clarify Lien Agent Notice.

House Bill 1101 would enhance the protection provided to persons making improvements to leased real property under Article 3 of Chapter 44A of the General Statutes. This bill did not contain the provisions considered by the LRC study committee which had troubled the NCLTA and other associations. The sole purpose of this bill is to address the situation that existed with a quasi-public construction project, which caused the Court of Appeals to call for remedial legislation in Pete Wall Plumbing Co. v. Sandra Anderson Builders, Inc., 721 S.E.2d 663 (N.C. App., 2011). Although House Bill 1101 passed the House and was approved by the Senate Judiciary I Committee, this bill was not enacted into law this session.

House Bill 1102 was requested by NCLTA. House Bill 1102 clarifies the information required to be provided on the Notice to Lien Agent form. The bill requires the information provided on the form to be legible. The bill provides that a notice to lien agent form shall not be combined with or make reference to a notice of subcontract or notice of claim of lien upon funds. The bill provides that designation of a lien agent would not make the lien agent an agent of the owner for purposes of receiving a notice of subcontract.

Introduced by Representatives Stevens and Arp, House Bill 1102 passed the House by a vote of 114 to 0, passed the Senate Judiciary I Committee unanimously, but then stalled in the Senate. The Senate leadership took the position that this bill was not eligible for consideration in the Senate because it originated from a House-only study committee.

Therefore, Representative Stevens, Senator Barringer (the Senate “sponsor”), and I worked to have the provisions of this bill added to the “technical corrections bill” that would be considered in the last days of the legislative session.

The provisions of House Bill 1102 were added to House Bill 1133, Technical and Other Corrections, the legislature’s end of session technical corrections bill. The provisions were added in the House, the bill passed the House, and it was sent to the Senate. The Senate approved House Bill 1133 and returned it to the House to consider the Senate changes. The House initially voted not to accept the Senate changes (the Senate added some new provisions unrelated to the mechanics lien provision), and for much of the last days of session, it appeared the House would not approve the technical corrections bill this year. I spoke to a number of House members regarding our mechanic’s lien provision and its time sensitivity. Ultimately, the House approved House Bill 1133. So the original provisions of House Bill 1102 were approved by the legislature in House Bill 1133 and were signed by the Governor on August 14, 2014. Effective on August 14, 2014. Session Law 2014-115.

Definition Of Practice of Law – LegalZoom

The original contents of House Bill 663 were removed and replaced in the Senate Judiciary I Committee with House Bill 663, Define Practice of Law, a bill to exclude certain items and matters from the definition of the practice of law.

The bill provided that: “(b) The phrase "practice law" does not encompass any of the following: … (2) The design, creation, assembly, completion, publication, distribution, display, or sale, including by means of an Internet Web site, of self-help legal written materials, books, documents, templates, forms, computer software, or similar products if the products clearly and conspicuously state that the products are not a substitute for the advice of an attorney."

Senator Goolsby (R-New Hanover) introduced the provision. LegalZoom lobbyists were present and spoke for the provision. The NC State Bar and RELANC spoke against it in committee. The NC Bar Association did not state a position at the committee meeting, but later announced that they oppose the provision as drafted. After much debate, the bill was approved by the committee with some "no" votes.

The bill was originally scheduled for consideration in the full Senate a few days later. However it was removed from the Senate calendar to give LegalZoom and the State Bar a chance to meet and confer to see if a compromise could be reached.

The State Bar proposed the following compromise that LegalZoom accepted (Note: This is the last version that was circulated. There may have been subsequent changes):

“(b) The phrase "practice law" does not encompass any of the following:

(2) The production, distribution or sale of materials, provided that:

(a) The production of the materials must have occurred entirely before any contact between the provider and the consumer;

(b) During and after initial contact between the provider and the consumer, the provider’s participation in creating or completing any materials must be limited to typing, writing, or reproducing exactly the information provided by the consumer as dictated by the consumer or deleting content that is visible to the consumer at the instruction of the consumer;

(c) The provider does not select or assist in the selection of the product for the consumer; provided, however, (i) operating a website that requires the consumer to select the product to be purchased, (ii) publishing descriptions of the products offered, when not done to address the consumer’s particular legal situation and when the products offered and the descriptions published to every consumer are identical, and (iii) publishing general information about the law, when not done to address the consumer’s particular legal situation and when the general information published to every consumer is identical, does not constitute assistance in selection of the product;

(d) The provider does not provide any individualized legal advice to or exercise any legal judgment for the consumer; provided, however, that publishing general information about the law and describing the products offered, when not done to address the consumer’s particular legal situation and when the general information published to every consumer is identical, does not constitute legal advice or the exercise of legal judgment;

(e) During and after initial contact between the provider and the consumer, the provider may not participate in any way in selecting the content of the finished materials;

(f) In the case of the sale of materials including information supplied by the consumer through an internet web site or otherwise, the consumer is provided a means to see the blank template or the final, completed product before finalizing a purchase of that product;

(g) The provider does not review the consumer’s final product for errors other than notifying the consumer (i) of spelling errors, (ii) that a required field has not been completed, and (iii) that information entered into a form or template by the consumer is factually inconsistent with other information entered into the form or template by the consumer;

(h) The provider must clearly and conspicuously communicate to the consumer that the materials are not a substitute for the advice or services of an attorney;

(i) The provider discloses its legal name and physical location and address to the consumer;

(j) The provider does not disclaim any warranties or liability and does not limit the recovery of damages or other remedies by the consumer; and

(k) The provider does not require the consumer to agree to jurisdiction or venue in any state other than North Carolina for the resolution of disputes between the provider and the consumer.

For purposes of this subsection, “production” shall mean design, creation, publication or display, including by means of an internet web site; “materials” shall mean legal written materials, books, documents, templates, forms, or computer software; and “provider” shall mean designer, creator, publisher, distributor, displayer or seller.”

Although the State Bar and LegalZoom reached a compromise, there were still groups that opposed the compromise, including NCLTA, RELANC and the Real Property Section of the Bar Association. Ultimately, the compromise bill was not enacted during the 2014 legislative session. I expect the issue to come up again in the 2015 legislative session.

Law Enforcement and DA Privacy/Local Government Websites

Originally, Senate Bill 78, Law Enforcement and DA Privacy/Tax Websites, addressed public construction projects. This bill was amended and changed in the House Rules Committee early in the session to a bill that would allow law enforcement officers, assistant district attorneys, and federal prosecutors to request that their personal information be removed from city or county websites. Representative Chris Malone (R-Wake) stated that the bill was in response to an incident in which the father of a Wake County assistant district attorney was kidnapped, as well as a number of complaints about threats faced by law enforcement personnel daily. Representative Malone reported that he has been told by some law enforcement officers that bad actors may use public records to find law enforcement and court officials with whom they have issues.

The bill did not define “personal information.” Information regarding the law enforcement officials would remain a public record, but it could not be displayed online once they asked for its removal. The bill, originally directed at local tax office websites, was expanded in committee to apply to all local government websites, to include the Register of Deeds database.

NCLTA had concerns with this bill, and I spoke to the House Judiciary C Committee and stated NCLTA’s concerns with the bill. In committee, prosecutors and law enforcement officers spoke for the bill, and described the threats they receive from those they arrest and prosecute.

Although Senate Bill 78, passed the House Judiciary C Committee, the bill was not reported in immediately by the committee chair, and we thought it may be delayed for the rest of the session. However, at the end of June, the bill was reported out of committee and was added to the House calendar. I worked with other lobbyists and legislators that shared our concerns with the bill to keep the bill from a vote. Ultimately after many requests, the bill sponsor agreed to turn the bill into a study – to be conducted by the NC Courts Commission (which is chaired by Rep. Stevens). After the bill was converted to a study, Senate Bill 78 passed the House 116-0 and was sent to the Senate where it was referred to the Senate Rules Committee.

The Senate did not act on Senate Bill 78 this session. However, House Bill 369, Criminal Law Changes, was amended in the Senate to provide that it would be a Class I felony to assault or threaten another person in retaliation against a legislative officer, executive officer, or court officer because of the exercise of that officer’s duties. In explaining the provision, Senator Goolsby (R-New Hanover) specifically referenced the incident in which the father of a Wake County assistant district attorney was kidnapped by a person prosecuted by the ADA. House Bill 369 was ultimately enacted by both the House and Senate and signed into law by Governor McCrory.

The bill that would remove information about certain court officials from local public websites was not enacted into law, nor was the study formally authorized. However, the Courts Commission will meet several times before the 2015 legislative session convenes, and the Commission has the inherent authority to study this issue. I understand that Representative Stevens, the Commission Chair, may review this issue at the Commission’s first meeting.

Bills of Interest

Senate Bill 734, Regulatory Reform Act of 2014, makes changes to the Residential Property Disclosure Act, Chapter 47E, to create a new section NCGS 47E-4.1 that provides for a new mineral and oil and gas rights mandatory disclosure statement (which replaces the existing form in NCGS 47E-4(b2)). Mineral rights are added to the disclosure statement, and the statement focuses on whether mineral, oil, and/or gas rights have been severed from the property. The bill also requires the following transactions to utilize this mandatory disclosure statement:

1. Transfers involving the first sale of a dwelling never inhabited.

2. Lease with option to purchase contracts where the lessee occupies or intends to occupy the dwelling.

3. Transfers between parties when both parties agree not to complete a residential property disclosure statement or an owners' association and mandatory covenants disclosure statement.

The form of the disclosure statement is set out in the statute, NCGS 47E-4.1(a). The provision requires the North Carolina Real Estate Commission to develop a disclosure statement to comply with this statute. Except as discussed above, the bill maintains the exemptions from the disclosure form listed in NCGS 47E-2 (1) through (8). Effective January 1, 2015 and applies to contracts executed on or after that date. Session Law 2014-__. (The Governor has until September 19, 2014 to sign this bill.)

Senate Bill 744, Appropriations Act of 2014. This is the State Budget bill. The bill sets the percentage rate to be used to calculate the insurance regulatory charge applicable to North Carolina insurance companies at 6.5% for the 2015 calendar year.

The bill abolishes four (4) special superior court judgeships, provides for two (2) additional business court judges, and creates a procedure for nomination and confirmation of special superior court judges. The new procedure will involve nomination of a candidate by the Governor, in consultation with the Chief Justice of the Supreme Court, and confirmation by the legislature. Effective: August 7, 2014. Session Law 2014-100.

Senate Bill 773, Implement GSC Recommendations, modifies the slayer statute, NCGS 31A-6, due to the need to account for property held in a joint tenancy in unequal shares. The bill clarifies the provision for filing certified copies of probated wills in other counties where a decedent has real property. The bill clarifies the time frame for substitution of a personal representative, and clarifies that the common law rule against accumulations no longer applies to trusts. Effective August 6, 2014. Session Law 2014-107.

Senate Bill 788, Town of Duck/Eminent Domain, allows the Town of Duck to exercise the power of eminent domain for purposes of engaging in beach erosion control and flood and hurricane protection works. Effective: July 25, 2014. Session Law 2014-86.

Senate Bill 877, Exempt Time-Shares/Rule Against Perpetuities, exempts certain real estate time-shares from the rule against perpetuities. The bill provides that the rule against perpetuities may not be applied to defeat any provision of time-share declaration or bylaws adopted and recorded at the Register of Deeds office prior to July 1, 1984. The bill provides that the Board of Directors of a time-share project may by 2/3 vote of the Board amend a provision within the time-share declaration if the provision was adopted as a part of the original recorded time-share declaration and the provision converts ownership of the time-share units to tenancy in common. The bill provides that title or interest in a time-share project or unit is not rendered unmarketable due to the time-share declaration’s “insubstantial failure” to comply with this section. Whether a substantial failure to comply with this statute impairs marketability shall be determined by the laws of the State related to marketability. The bill provides that this statute shall not otherwise impair the ability of the individual time-share owners' right under the time-share declaration, bylaws, or the laws of this State to vote to terminate the time-share project or to amend the declaration to provide for the termination of the time-share project and interests. Although the original bill only applied to Currituck and Dare Counties, the bill ultimately enacted applies statewide. Effective: August 5, 2014. Session Law 2014-99.

House Bill 330, Planned Community Act/Declarant Rights, amends the North Carolina Planned Community Act regarding the transfer of special declarant rights. The bill amends the definitions section, G.S. 47F-1-103, by adding additional terms and definitions to be used in this Act, including “affiliate of declarant” and “development rights”. The bill enacts new G.S. 47F-3- 104(b) to provide for and explain the liability that a transferor declarant assumes upon transfer of any special declarant rights. The bill enacts new G.S. 47F-3-104(c) to provide that, unless otherwise provided for, a person acquiring title of property being foreclosed or sold succeeds to all special declarant rights related to that property, held by the declarant, or those rights stated and reserved in the declaration, if requested in a recorded instrument. The bill enacts new G.S. 47F-3-104(d) to provide for what occurs to special declarant rights after a foreclosure of a security interest, sale by trustee, tax sale, judicial sale, bankruptcy sale, or receivership proceedings of all interests in a planned community.

The bill enacts new G.S. 47F-3-104(e) to provide for the liabilities and obligations of a person who succeeds to special declarant rights. The bill enacts new G.S. 47F-3-104(f) to provide that nothing in this section subjects any successor to a special declarant right to any claims against or other obligations of a transferor declarant other than claims and obligations arising under this Chapter or declaration. The bill enacts new G.S. 47F-3-104(g) to clarify that, for the purposes of this section, "assignment of declarant rights" includes any assignment by the declarant of special declarant rights to a person, including an assignment pursuant to this section. Effective: July 7, 2014. Session Law 2014-57.

House Bill 1056, Lake Lure Official Map/Deannexation, amends the charter of the Town of Lake Lure to include the plat and book number in the Rutherford County Register of Deeds Office where the official map of the Town's boundaries is recorded, and removes certain described property from the Town's corporate limits. Effective: July 23, 2014. Session Law 2014-81.

House Bill 1114, Elk Park/Deed Transferring Property, requires the Register of Deeds of Avery County to refuse recordation of a deed for property subject to delinquent municipal property taxes for the Town of Elk Park. Effective: July 16, 2014. Session Law 2014-69.

House Bill 1133, Technical and Other Corrections, makes the following changes of interest to NCLTA:

1. Clarifies an aspect of manufactured housing law. The bill amends NCGS § 24-1.1A, Contract rates on home loans secured by first mortgages or first deeds of trust, section (e), to add a security interest in a manufactured home to the definition of “home loan” under this section.

2. Gives husbands and wives tenancy by the entirety protection in property conveyed to certain trusts. The bill enacts a new section NCGS 39-13.7 to provide that any real property held by a husband and wife as tenancy by the entireties and conveyed to their joint revocable or irrevocable trust, or to their separate revocable or irrevocable trusts, shall have the same immunity from the claims of the spouses' separate creditors as would exist if the spouses had continued to hold the property as tenancy by the entireties, so long as (i) the spouses remain husband and wife, (ii) the real property continues to be held in the trust or trusts, and (iii) the spouses remain the beneficial owners of the real property.

3. Amends NCGS 45A-4(a) to clarify that a settlement agent may disburse funds from the settlement agent's trust or escrow account (to either the applicable register of deeds or directly to a private company authorized to electronically record documents with the office of the register of deeds) as necessary to record any deeds, deeds of trust, and any other documents required to be filed in connection with the closing, including excise tax (revenue stamps) and recording fees. However, the settlement agent may not disburse any other funds from its trust or escrow account until the deeds, deeds of trust, and other required loan documents have been recorded in the office of the register of deeds.

Effective: August 11, 2014. Session Law 2014-115.

Bills of Interest Not Enacted

Senate Bill 837, Criminal Background Check for Notaries Public, would require criminal background checks as a part of the process to commission notaries public. Senate Bill 837 was not enacted into law this session.

By: David P. Ferrell, Esq.

NCLTA Legislative Counsel

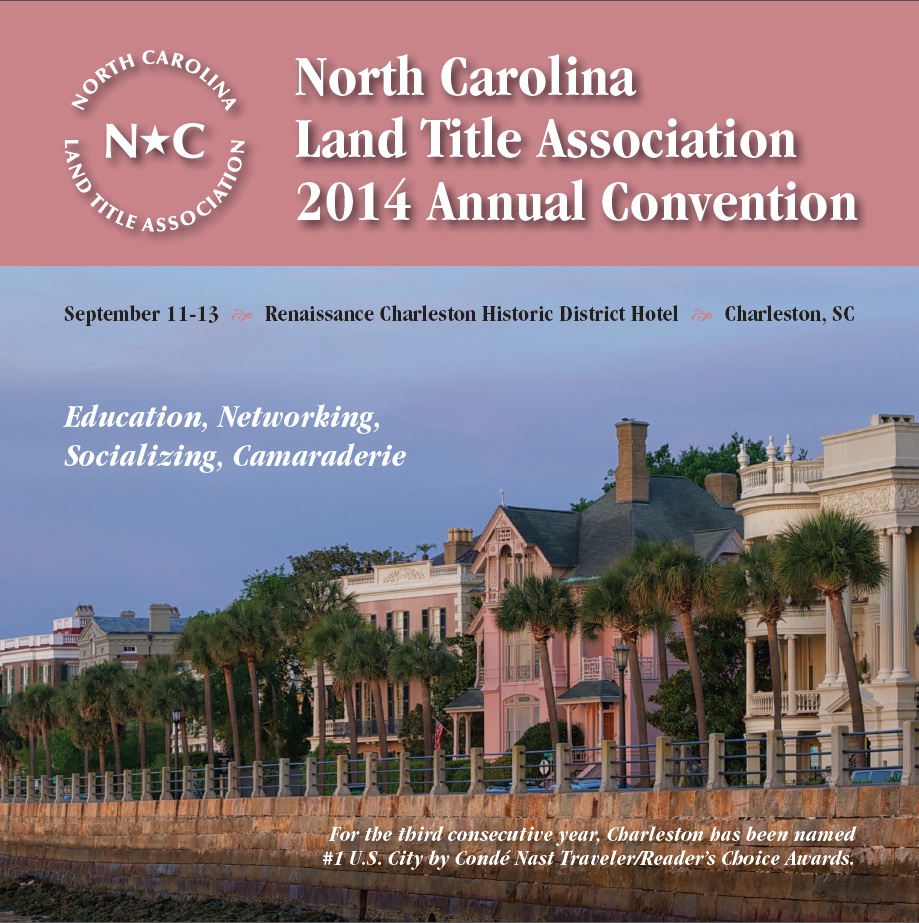

Annual Convention

It's not too late to join us for the NCLTA annual convention, September 11th through the 13th! In addition to the great line-up of speakers and topics for the conference, the annual Friday Night Banquet will offer a low-country buffet consisitng of shrimp and grits and other traditional fare. Come enjoy networking and mingling with your colleagues in downtown Charleston.

For all the details please visit www.nclta.org/2014Convention. The Final Program and speaker presentations will be posted soon!

North Carolina/South Carolina Border Discussion

“Now that we’re not in South Carolina anymore, what are you doing to fix it?”

The line between SC and NC was originally surveyed in 1772. This survey was conducted jointly by surveyors appointed by the governor of each state, and subsequently ratified by both state legislatures. The original 1772 survey plat shows trees marked every mile, but is devoid of any reference to bearings and distances and no permanent monuments were set along the line during the course of this original survey. With marked trees being the only evidence left in the field from the original survey, it comes as no surprise that modern surveying techniques and new technology have disclosed substantial variations in the recognized location of the original Boundary.

The Boundary Commissions of North Carolina and South Carolina formed a joint commission to determine the true location of the Boundary. The process has been under way for eighteen years and the common boundary has been surveyed using modern technology to determine the correct line. The result is that the line is, in certain locations, not where it was thought to have been. Properties thought to have been in SC will now be recognized as properly being in NC and vice versa. States have the power to negotiate a new boundary, but must have the consent of the U.S. Congress to do so. Absent such a monumental task, the only alternative to dealing with this issue requires identifying the true Boundary and then dealing with resulting issues in a way that imposes the least harm to affected landowners and next, affected governments. It is important to understand, the Boundary has not ‘moved’ and to keep the issues in focus such terminology should not be used as it leads to misdirection on the issue, particularly with respect to land title.

This has major ramifications all across the southern boundary of the state, not the least of which is how to document title on parcels that have been treated as being in one state and are now found to be located in the other state such as differences in how title passes by operation of law (no anti-deficiency statute, Tenancy by the Entirety is not recognized, no equivalent N.C.G.S. Section 29-30 marital rights in South Carolina, etc.). Other issues involve the regulatory authority over roads and highways, utilities (Utility service territories and regulation of water, sewer, electric, telephone and cable, plants, lines and easements), property taxes (real, personal and business), ABC taxes, franchise and license taxes, sale of regulated goods (fireworks), etc. In addition to the taxation issues, there also, mail, police, fire and EMT protection/jurisdiction issues, school districts and in-state tuition. Licensing is a major issue, applying to vehicles, drivers, businesses and professions. one doctor’s office is now recognized as being in a state where he is not licensed and a Boundary gas station that sells fireworks and alcohol is now not properly licensed and reportedly can’t qualify under the laws of the estate where it is actually located.

With regard to the issue of establishing the true boundary line, the surveyors were, not surprisingly, unsuccessful in physically locating any of the old trees, but did find references to some of the original state line boundary trees in land records of the era after 1772 until about 1850 when the trees were likely to have still existed. In some cases they were referenced in available private property surveys conducted after 1772 and were able to establish the original geographic location of 1772 boundary trees by using such instruments and tracing the chain of boundary titles. Representatives from the boundary commission from both states also agree on the geographic position of the two end points.

From the work done locating the positions of the boundary trees it became apparent that the original survey line did not run perfectly straight. This is as would be expected, because the original surveyors used a magnetic compass for direction which would not reasonably be expected to produce a straight line along the extensive length of the Boundary. The line as recovered is actually very close to where it was recognized in many instances, but also significantly different in others resulting in some Boundary properties only slightly shifting where the line already was recognized as crossing through the parcel and others shifting the recognized state entirely. The NC/SC Joint Boundary Line Commission is now working on promulgating legislation for both states to deal with these issues.

The South Carolina Approach:

The South Carolina Boundary commission at the point of this writing is essentially promulgating separate drafts of legislation within the respective areas of taxation, title, mortgages, Medicaid, utilities, recording and in-state tuition. To go into those areas in depth is beyond the scope and space allowed of this article. Focusing on the title legislation, the South Carolina draft limits its application to the South Carolina counties bordering North Carolina east of Greenville County (Spartanburg,

Cherokee, York, Lancaster, Chesterfield, Marlboro, Dillon and Horry). Upon enactment of South Carolina legislation approving the clarified boundary, clerks of court and registers of deeds must provide notice of the statute’s provisions to attorneys and others using their offices by means they would normally utilize to provide general notices to users such as by postings on their web pages.

The owner of land evidenced by title instruments of record to real property previously believed to be located in whole or in part in North Carolina and which is determined to be located in whole or in part in South Carolina on the effective date of South Carolina legislation approving the clarified North Carolina-South Carolina boundary may record a “a certificate of new recording” for each document that has been previously recorded in North Carolina with the register of the county where the property is located in order to protect its priority for recording in South Carolina. The certificate may be executed by the owner of record in North Carolina or any other person having an interest in the property. The certificate may contain a properly cited derivation clause and if the owner is deceased, disabled or otherwise legally unable to execute a certificate, the person holding legal title to the property or holding a power of attorney may execute it and attaching a document recognized under North Carolina law as showing ownership or authority to act for the record owner. The certificate may reference all recording information regarding all instruments, plats, deeds and estates affecting the property and the location of the original instrument in North Carolina.

This differs significantly in North Carolina in that we already have a statute that would permit anyone to record a certified copy of a document of recorded anywhere including South Carolina, see: N.C.G.S. Section 47-31. If a recordable instrument has never been recorded in either South Carolina or North Carolina, the original instrument must be recorded in South Carolina with the appropriate register or clerk in South Carolina. If the title to the property was derived from an inheritance in North Carolina and no deed of distribution exists as is required in South Carolina, a certificate of new recording may be filed in South Carolina which must include information about the derivation of the title to the property which would be sufficient for someone searching title in North Carolina to determine the chain of title to the property in North Carolina prior to the recording of the certificate in South Carolina. A significant limitation implicit in this provision is that the examiner will need to be fully conversant with North Carolina real property law.

The proposed draft declares that all legal interests in property prior to the effective date of South Carolina legislation approving the clarified North Carolina-South Carolina boundary shall be determined in accordance with North Carolina law. Prior title, liability and casualty insurance policies continue in effect so long as the property owner maintains any payments and other requirements of those policies. Liability and casualty insurance policies may not be cancelled due to the boundary clarification absent a minimum of thirty days’ written notice to the owner. Should the insurer be a registered South Carolina insurance carrier, they may not cancel.

The filing of the certificate is not mandatory, is intended to be an aid to filing and research of real property transactions and the failure to file will not defeat title or priority existing in the applicable jurisdiction. Even absent filing a certificate, priority for recording will relate back to the original documents and priority established in the state from which the recording originally existed. No new priority is established by the recording a Certificate of New Recording or failing to do so.

With respect to mortgages in the affected counties, the proposed South Carolina draft would permit or require foreclosure proceedings under the terms of a mortgage on that property to be brought in the state in which the mortgage was entered applying the law applicable to the mortgage when it was entered.

The North Carolina Approach:

One important note: As of now, the Local Government Division North Carolina Department of Revenue has interpreted N.C.G.S. Section 105-287 to permit affected County tax offices to elect, as several have elected, NOT to pursue omitted taxes, nor issue refunds should a taxpayer come forward seeking one on affected properties. They are proceeding under N.C.G.S. Section 105-287, and making the required changes effective for 2014 forward except where the new boundary survey has already incorporated into a recorded plat prior to the recordation of the full survey as it applies to affected counties.

In order to assure appropriate consideration of the title issues affecting land owners an ad hoc committee was formed by the North Carolina Boundary Commission to consider real property title issues associated with the planned realignment of the North Carolina/South Carolina boundary as well as recommending provisions of or drafting a statutory proposal for consideration by the North Carolina/South Carolina Boundary Commission. This proposal is the work of a diverse group of individuals composed of representatives from the North Carolina Land Title Association, the North Carolina Secretary of State’s, the North Carolina Attorney General’s office, the Local Government Division, North Carolina Department of Revenue, North Carolina Association of Assessing Officers and the North Carolina Association of Tax Collectors, North Carolina Register of Deeds Association, North Carolina Bar Association, Real Property Section

With respect to drafting North Carolina title legislation, several differing proposals were suggested early on in the process. Some proposals would have required a chain of title to be searched and the muniments of title recorded as the esc proposal allows and is already permissible under our current recording acts. The proposals implied that the instruments of title revealed by a true ‘full’ search will be incorporated into a recorded chain of title which might prove prohibitively expensive to landowners. Other proposals suggest a thirty-year search as being sufficient. One problem with this concept is that it ignores the clear implications of the inadequacy of the Marketable Title Act in North Carolina as proof of title as opposed to it being an extremely limited statute of repose. Without discoursing further upon the wisdom or the practicability of using such a remedy, it seems clear to that most if not virtually all of affected properties will not be urban or highly developed and a 30-year chain of title will be totally inadequate as the basis for a ‘satisfactory’ title opinion upon which title companies can lawfully issue title policies. There are simply far too many easements, covenants, interests and property rights that are more than likely to exist and not be cut off by a Marketable Title Act approach.

The realignment of the boundary with our neighboring states has the potential to create very difficult challenges for the citizens or our state who own properties that will be affected. The purpose of this draft proposal is to ameliorate, to the extent possible, at least some of those challenges in a manner that will not be prohibitively costly for those affected citizens. The proposed statue currently on the table makes legislative findings to support the necessity of remedial legislation and would adopt a new Article 2 of Chapter 141 of the General Statutes. The new Article incorporates a definitions section in order to create a uniform terminology with respect to realignment issues. It is the hope of the ad hoc committee that South Carolina will at least adopt the same definitions so that the issues may be addressed more consistently across the Boundary.

The proposal essentially employs a three-pronged approach to accomplish this. First, it provides for the recording by the owner of a Notice of State Boundary Abutter. Secondly, it provides for an Affidavit of Title of State Boundary Abutter which requires a title examination by a licensed attorney with suitable experience. Finally, the draft would provide an appeal mechanism for an aggrieved owner claiming a contrary interest in affected land by the creation of a quasi-judicial proceeding before a newly created North Carolina Boundary Realignment Hearing Commission.

The “Notice of State Boundary Abutter” may be filed by anyone claiming an interest in affected lands and the filing only operates as a record notice of the claimed interest for recording act purposes. In effect, it is just a place holder and does not of itself establish any title contrary to the true ownership. To discourage continued recording in the erroneous jurisdiction, the statute provides that such instruments registered after the effective date of a proclamation effecting a will have no force and effect and do not give notice constructive or actual until properly recorded in the correct North Carolina County. A model form is promulgated but not required and perjury penalties are imposed.

The second prong is to provide a mechanism and procedure for creating a prima facie title record without having to re-record all the instruments (or certified copies) establishing an unbroken chain of title back to the original grant. To accomplish this, provision is made for recording an attorney’s opinion on title in the form of an “Affidavit of Title of State Boundary Abutter” that may be relied upon by good faith purchasers for value. The proposed statute provides for minimum standards of competency, for disclosure of competing claims, for notice to known claimants and for liability protection for the certifying attorneys. A model form is promulgated but not required. It would seem evident that due to Unauthorized Practice of Law issues, a South Carolina attorney can’t certify title to North Carolina property. However, as the statute would adopt the existing treatment of the property under the laws of the jurisdiction where it had been mistakenly believed to be located as controlling, in the case of South Carolina, a South Carolina licensed attorney with substantial real property experience would be required for an opinion on title to be meaningful. The statute would permit North Carolina attorneys to rely upon such opinions absent actual knowledge of any inaccuracies, however and perjury penalties are imposed.

The third prong was drafted with alternative options for the Boundary Commission or Legislature and would provide a mechanism to resolve title disputes arising from the realignment. One method designed to expeditiously and affordably resolve such disputes without immediate resort to the courts, would create a Hearing Commission composed of three person panels of knowledgeable hearing officers. If adopted, it could serve as an alternative dispute resolution mechanism for all sorts of title disputes beyond boundary realignment. Assuming that there may be budgetary impediments to such a system, the draft includes an alternate method by resorting to a stated right to being a quiet title action. Both options would adopt a reasonable 7-year statute of repose.

One change that the realignment makes necessary will likely have broader application than documenting a record chain of title. South Carolina makes use of mortgages rather than deeds of trust as are most commonly used in North Carolina. The North Carolina practice derives from the old common law doctrines protecting the mortgagor’s equity of redemption and making a mortgagee’s bidding in the property at foreclosure presumptively invalid. To protect the status quo with respect to affected lands, it is far simpler to change the doctrine and permit the mortgagee to bin in at the foreclosure sale. To accomplish this, Chapter 45 would be modified to permit mortgagees to appoint a trustee who will succeed to all the rights, titles, authority, and duties of the mortgagee under the terms of the mortgage and the mortgagee will be entitled to bid at a foreclosure sale without limitation. In addition the Chapter 45 amendment reinforces that a mortgagee may record the Notice and Affidavit of title provided for in the Chapter 141 amendments. Other changes as are encompassed in the South Carolina proposal were deemed unnecessary. In North Carolina, the case law is clear that an unrecorded mortgage or deed of trust may be foreclosed, therefore the commencement of an action coupled with a filing of a notice of lis pendens and the recording of a sufficient title affidavit will permit the valid foreclosure of affected property in North Carolina.

The proposed legislation would leave tribal lands unaffected. The most current North Carolina Land Title Association proposal for North Carolina boundary legislation is now being circulated. While there will likely be changes in the legislative process, we believe the principal parts will be accepted and suspect that the hearing commission will be the most likely part to be eliminated. Other concerns as discussed above will need to be addressed. Most of them will be able to be incorporated in to this draft in additional sections and may fit within the framework of Chapter 141.

This article is reprinted courtesy of and with permission of Statewide Title, Inc.

Pete Wall Plumbing Co., Inc. v. Sandra Anderson Builders, Inc., 215 N.C. App. 220, 721 S.E.2d 663 (2011).

Introduction

That rumbling you hear is a potentially seismic shift brewing for North Carolina lien law as a result of the Court of Appeals decision in Pete Wall Plumbing Co., Inc. v. Sandra Anderson Builders, Inc., 215 N.C. App. 220, 721 S.E.2d 663 (2011). Now, there is a move afoot to allow contractors doing work for a tenant to place a lien directly on the fee interest in the property which would greatly expand searches, underwriting requirements, and closing customs.

Under North Carolina law, it has been clear for years that mechanics and materialmen (“Contractors”) working for a tenant could only place a lien on the tenancy, not on the fee ownership. Interestingly, the Court of Appeals did not change anything with its decision in Pete Wall Plumbing. In fact, their holding was in accordance with long-held and well-established precedent that had not previously generated much controversy. However, because of some bad facts in the case, at least one Judge thought the result unfair, and now there is an effort at the General Assembly to change the law. Title professionals need to become engaged with the issue as even a seemingly minor and justified change in the law could have dramatic implications in an area that had seemed settled.

Summary of Current Law and Recent Case

Under Article X, Section 3 of the North Carolina Constitution, N.C. Gen. Stat. § 44A and the holding in Brown v. Ward, 221 N.C. 344, 20 S.E.2d 324 (1942), Contractors have lien rights against the property on which they work. However, their lien rights attach only to the interest of the party with whom they contracted. If the Contractor is working for a tenant, then the lien attaches only to the tenancy. If the tenancy terminates, there is no longer any interest to which their lien can attach.

In its simplest iteration, Pete Wall Plumbing involved the owner of several lots who leased property to a developer who in turn subleased it to a builder. A Contractor for the builder was not paid and filed a lien against all parties. While the Contractor won a money judgment against the builder, the Contractor was unable to enforce a lien against the property because the builder’s lease had been terminated and they had no rights against the fee. The bad facts come to light upon closer inspection which reveals a complex structure seemingly designed to avoid the payment bond requirements for a public works project.

The fee owner was the Housing Authority of the City of Greensboro (“Housing Authority”) who wanted to build a project of six houses on lots in Willow Oaks – Zone B (the “Lots”). If the Housing Authority contracted directly with the builder to build the houses, they would have had to post a payment bond under Article 3 of N.C. Gen. Stat. § 44A. Instead, the Housing Authority entered into a ground lease of the property to Willow Oaks Development, LLC (“Willow Oaks”) who in turn subleased it to Sandra Anderson Builders, Inc. (“SAB”). Pete Wall Plumbing, 721 S.E.2d 665.

In the leases and subleases (all of which were recorded), SAB agreed to construct single-family homes on the Lots. The subleases provided that SAB would be the owner of these improvements during the term of the subleases but that, upon completion, SAB was required to convey the homes to an individual homebuyer “in accordance with the provisions set forth in the Master Ground Lease.” Id at 665. The subleases specifically stated that SAB had no right to bind any interest of Willow Oaks to any lien or other security interest. Id.

As a result of this unconventional structure, the Housing Authority was not required to post a payment bond. In addition, the leases and subleases contained standard provision allowing the Housing Authority, as landlord, to terminate them if a lien was placed on the tenant/subtenant. Id. Thus, as soon as a Contractor obtained lien rights against the subtenant, the property right to which those rights attached could be terminated – plus, there was no payment bond against which the Contractor could collect.

Of course, that happened. In late 2007 and early 2008, Carolina Bank made a series of loans to SAB to finance the construction of the houses on each Lot, and SAB granted a Deed of Trust in its subleasehold interest on each subject Lot. The Housing Authority and Willow Oaks subordinated their interest in the Lots to the liens of the Deeds of Trust pursuant to a series of recorded Multiparty Agreements with Carolina Bank and SAB which, in the event of a default, allowed the parties to give Carolina Bank title to the respective Lot. Id.

Pete Wall Plumbing Co. (“Pete Wall Plumbing”) provided plumbing services for the construction per a contract with SAB. When SAB failed to pay, Pete Wall Plumbing filed liens (the “Plumbing Liens”) against SAB, Willow Oaks and the Housing Authority with regard to the Lots. As required to enforce their lien, Pete Wall Plumbing filed suit in August 2008, naming SAB, Sandra B. Anderson (Groat), the Housing Authority, Willow Oaks, Carolina Bank, and the private owners as defendants (collectively “defendants”). In the complaint, Pete Wall Plumbing alleged (among other things) that it had valid liens against the Lots and sought an “equitable lien” against the interests of the Housing Authority and Willow Oaks. Id at 666.

However, on each Lot, Pete Wall Plumbing faced problems enforcing their lien:

· Out Sales – Four of the Lots had been sold to individual homebuyers prior to the filing of the Plumbing Liens, so enforcing the liens would impact the buyers.

· Foreclosure – While SAB still had an interest in the two unsold lots, in each case, Carolina Bank’s Deed of Trust was recorded prior to the date Pete Wall Plumbing alleged it first furnished work. Carolina Bank foreclosed on the two unsold Lots on February 4, 2009, and subsequently took title via trustee’s deed.

Carolina Bank won easily on the two unsold lots. Their Deed of Trust clearly had priority, and the foreclosure cut off the Plumbing Liens. On the four sold Lots, however, any liens allowed to stand would have priority over the sales. At closing the purchasers received general warranty deeds from the Housing Authority and SAB, and each deed provided that the subject Lot was released from the respective Lease, Sublease and Multiparty Agreement and that such agreements were terminated and “shall have no further force or effect with respect to the property” conveyed. Id.

After a series of hearings and motions, the trial court found that the Plumbing Liens were invalid and “further stated that ‘[u]pon the filing of this order with the Clerk of Superior Court, the Notices of and Claims of Lien [for all the properties] shall be marked as discharged, pursuant to N.C.G.S. § 44A–16.’” Id. Not surprisingly, Pete Wall Plumbing appealed.

After some discussion of procedural irregularities, the Court of Appeals upheld the trial court’s dismissal of the liens under N.C. Gen. Stat. § 44A–16(4). Id. The Court notes that “[o]ur Supreme Court has explicitly approved the judicial enforcement of a materialman’s lien against a leasehold…when the enforcement is completed before the interest terminates.” Id at 669 (citations omitted). But, since N.C. Gen. Stat. § 44A–9 only provides a lien “to the extent of the interest of the owner”, the Court also held that “[Pete Wall Plumbing] possessed no statutory protection in the private owners' properties after SAB's interest in each property was terminated.” Id.

The Court noted that all of the leases, subleases and agreements were public record. Further, the Court noted that the Supreme Court had previously admonished a party similarly situated to Pete Wall Plumbing – “[i]f [plaintiff was] unwilling to do the work and furnish the material upon ... credit and intended to look to the security provided by statute, ordinary prudence required that [plaintiff] exercise that degree of diligence which would enable them to ascertain the status of the title to the land upon which the building was to be erected and to obtain the approval or procurement of the owners. Their loss must be attributed to their failure so to do.” Brown v. Ward, 20 S.E.2d 324, 326–27, as quoted in Pete Wall Plumbing, 721 S.E.2d 669.

As a result, parties asked to perform work for a tenant need to (i) factor their client’s “ownership” into their determination of the tenant’s creditworthiness and (ii) decide if they need address lien rights with the fee owner.

Discontent & Movement for Change

The decision in Pete Wall Plumbing seems harsh because, while the Contractor could theoretically get a lien on the tenancy, the leases allowed the landlord to terminate the lease as soon as that happened. Effectively, the Contractor had nothing to which their lien could attach.

Even Judge Steelman, who voted for the decision, lamented the result. In his concurring opinion, he acknowledges that the Court “reaches the correct legal conclusions under the present state of our statutory and case law” but complains that current law “does not provide adequate protection to suppliers of labor and materials [on leaseholds].” Id at 671. Consequently Judge Steelman urges that “[t]he Supreme Court should reconsider its holding in Brown and the General Assembly should consider revising the provisions of Chapter 44A to prevent this unjust result.” Id at 672.

Additionally, Judge Steelman decries the use of complex arrangements that seem designed solely “to eliminate the possibility of any lien ever attaching to the lots and improvements in question.” Id. In fact, he recommends that the parties in such arrangements be deemed “joint venturers” and that agreements to prevent the attachment of liens be deemed “void as against public policy.” Id.

As if on cue, the General Assembly is looking at all of these issues.

Legislative Discussions

In 2014, the Legislative Research Commission’s House Committee on Mechanics Liens and Leasehold Improvements (the “Lien Committee”) held four hearings/meetings about various proposals about tenant lien rights in early 2014 (they also discussed other business, but nothing as interesting to this author). At those meetings, representatives of the Contractor industry argued for amendments to allow liens for work done for the benefit of a tenant to attach to the fee. So far, the Committee has resisted such a drastic change in the law, but it has recommended some changes to codify and clarify current case law. (See Report to the 2014 Session of the 2013 General Assembly of North Carolina by the Legislative Research Commission’s House Committee on Mechanics Liens and Leasehold Improvements dated April 7, 2014) (the “Report”).

According to the Report, the Lien Committee entertained proposals from various contracting companies and Contractor associations. At the first meeting, some proposals were as drastic as deeming the tenant to be an agent of the owner so that any work done for the tenant would be “authorized” by the owner which would allow any resulting lien to attach to the fee.

In later meetings, a representative of the North Carolina Bankers Association warned about the chilling effect such amendments could have on lending. Without certainty as to their lien position, lenders might not lend. A commercial property manager argued that Contractors know (or can figure out) when they are working for a tenant and take appropriate precautions on their own.

At the meeting on March 7, 2014, the Lien Committee discussed proposed legislation to accomplish the following:

· Section 1 – Lien Rights

o Codify the rule that a tenant is not an agent of the owner simply by virtue of the lease.

o Allow a contractor seeking to enforce a lien to present evidence to establish that the tenant was acting as agent for the owner or as joint venture with the owner.

· Section 2 – Payment and Performance Bonds

o Prevent public authorities from avoiding bond requirements by leasing to parties obligated to construct improvements for the public authority.

o Void other provisions designed to avoid bond requirements.

o Allow some exceptions for public-private partnerships under N.C. Gen. Stat. § 143-128.1C.

· Section 3 – Lease Terms

o Invalidate any lease provision that allows the landlord to terminate the lease if a lien is placed on the leasehold interest.

Various speakers opposed Sections 1 and/or 3, but there was no opposition to Section 2. Proposals to address Sections 1 and 3 varied. One speaker wanted Contractors for the tenant to be able to file a Notice of Potential Lien Claimant with the owner. If the owner did not object in a prescribed time period, the lien would attach to the fee. However, there was no committee support for this proposal. At the April meeting, the Lien Committee approved the Report and proposed legislation for further consideration in the 2014 short session as HB 1101.

(See sidebar with bill text current as of 29 May 2014)

Analysis of Proposals

As indicated, Section 2 of the proposal is relatively non-controversial. The performance bond requirement for public projects exists for a reason, and it seems like governmental agencies ought not structure transactions to avoid legal requirements. However, the proposals in Sections 1 and 3 could create problems for the title insurance industry and real estate in general that need to be considered before final adoption.

Section 1 deals with the relationship of the landlord and tenant as it affects lien rights. All of the proposals for Section 1 (as well as the more radical suggestions described above and rejected by the Lien Committee) could create significant uncertainty about lien priority at the time of any sale or loan closing. Obviously, codifying the rule that a tenant is not automatically an agent of the owner is helpful, but allowing a Contractor to argue that the tenant acted as an agent of the owner could be problematic without clear standards. Webster’s Real Estate Law in North Carolina already acknowledges that a tenant could be deemed the agent of the owner in certain circumstances (see Sec. 20-14(b)), but if the statutory provisions are read to make an agency relationship more likely, parties to real estate transactions may require more information and releases prior to closing.

In addition, the Contractor seems to be in the best position to solve any problems prior to doing the work. They can quickly determine who owns the property, and, if they do not trust the tenant to pay, obtain the owner’s consent to (or guaranty payment for) the work or require a deposit. The Lien Committee noted this in the Report, and the Supreme Court noted it in the 1942 decision in Brown v. Ward, cited above.

Establishing lien rights in advance seems better and simpler than opening up a Pandora’s Box of future lien claims based on agency. Buyers, lenders and title companies would have great difficulty consummating transactions if they had to underwrite the risk of tenant construction, assess the truth of tenant representations and chase down any tenant Contractors to get the appropriate waivers. That could prove impossible in even small shopping centers.

The Section 3 proposal would void lease provisions allowing a landlord to immediately terminate a lease upon the filing of a mechanics lien against a tenant. While that would seem fair to contractors, it might cause problems for owners looking to rent their property. The owner might not like having a Contractor take over the tenant’s space after enforcing the lien. The Contractor (or any new tenant) might be significantly less desirable and not of the owner’s choosing. Surely there are alternative measures that might have a lesser impact on lease terms, especially since there does not seem to have been a groundswell of controversy on this topic prior to Pete Wall Plumbing. That being said, at least this would not appear to be a title issue.

Conclusion

The surprising reaction to the predictable decision in Pete Wall Plumbing shows the necessity of both keeping up with current issues as well as the difficulty of changing settled law to fix a bad fact pattern. While Contractors working for tenants have precarious lien rights at best, the proposed changes open the door to more problems that do not appear to be considered. Given that Contractors working for tenants have the ability to negotiate a solution to their problems in advance, it would seem more sensible to consider the broader impacts of the proposed changes prior to changing settled law that seemed to work in the vast majority of cases.

GENERAL ASSEMBLY OF NORTH CAROLINA

SESSION 2013

H 2

HOUSE BILL 1101

Committee Substitute Favorable 5/28/14

|

Short Title: Mechanics Liens ‑ Leased Public Property.

|

(Public)

|

|

Sponsors:

|

|

|

Referred to:

|

|

|

|

|

|

May 19, 2014

A BILL TO BE ENTITLED

AN ACT to enhance the protection provided to persons making improvements to leased real property under Article 3 of Chapter 44A of The General Statutes, as recommended by the LRC COMMITTEE ON MECHANICS LIENS and leasehold improvements.

The General Assembly of North Carolina enacts:

SECTION 1. G.S. 44A‑26 reads as rewritten:

"§ 44A‑26. Bonds required.

(a) When the total amount of construction contracts awarded for any one project exceeds three hundred thousand dollars ($300,000), a performance and payment bond as set forth in (1) and (2) is required by the contracting body from any contractor or construction manager at risk with a contract more than fifty thousand dollars ($50,000); provided that, for State departments, State agencies, and The University of North Carolina and its constituent institutions, a performance and payment bond is required in accordance with this subsection if the total amount of construction contracts awarded for any one project exceeds five hundred thousand dollars ($500,000). In the discretion of the contracting body, a performance and payment bond may be required on any construction contract as follows:

(1) A performance bond in the amount of one hundred percent (100%) of the construction contract amount, conditioned upon the faithful performance of the contract in accordance with the plans, specifications and conditions of the contract. Such bond shall be solely for the protection of the contracting body that is constructing the project.

(2) A payment bond in the amount of one hundred percent (100%) of the construction contract amount, conditioned upon the prompt payment for all labor or materials for which a contractor or subcontractor is liable. The payment bond shall be solely for the protection of the persons furnishing materials or performing labor for which a contractor, subcontractor, or construction manager at risk is liable.

(b) The performance bond and the payment bond shall be executed by one or more surety companies legally authorized to do business in the State of North Carolina and shall become effective upon the awarding of the construction contract.

(c) No lease or other contract provision shall be effective to exempt, from the requirements of this Article, a project otherwise subject to the requirements of subsection (a) of this section, and any contract provision that purports to do so is void and unenforceable as against public policy.

(d) A person that leases real property from a contracting body shall require performance and payment bonds meeting the requirements of subdivisions (1) and (2) of subsection (a) of this section for construction, reconstruction, alteration, or repair of any public building or public work on the leased real property if all of the following apply:

(1) The contracting body requires the lessee to construct, reconstruct, alter, or repair the public building or other public work or public improvement on the leased real property.

(2) This Article would require the contracting body to require performance and payment bonds from contractors or construction managers if the contracting body had entered into a construction contract for the work required of the lessee.

For purposes of this subsection, any building or other work or improvement constructed upon land owned by a contracting body shall be deemed to be a public building or other public work or public improvement.

(e) Subsections (c) and (d) of this section do not apply to public‑private partnership construction contracts that are subject to G.S. 143‑128.1C."

SECTION 2. This act becomes effective October 1, 2014, and applies to leases or other contracts entered into on or after that date.

Criminal Tactic: Fraudulent Change of Business Registration Information

For the cost of a filing or processing fee, typically $10 to $20 in many states, thieves may attempt to file a

fraudulent change of your business address, or file changes to your business’s officers, directors or registered agent.

The Danger to You and Your Business: Changing your business’s officers or directors places the thieves in a perceived position of control over your business’ operations, as far as outside parties are concerned, with corresponding authority to act on behalf of your business. For example, by making themselves or an accomplice president or secretary, a criminal may be able to initiate the fraudulent sale of your business assets; conduct transactions or make purchases in your business’s name; open or access your business bank accounts; and open or access loans, lines of credit and other credit accounts—including those that require a personal guarantee by an owner of officer of the business.

Likewise, changing your business’s registered address or registered agent can place the thieves in receipt and control of important mailed notices and statements, or service of legal process, which might otherwise alert you that your business has been victimized.

Tips to Avoid Being Scammed: The best way to protect a company’s business identity is to sign up for email notifications that may be offered by your secretary of state. Some states will notify companies when a form has been filed affecting a business record or when the status of a record has changed. Another option is to develop and perform a quarterly secretary of state search policy.

Copyright © 2004-2014 American Land Title Association. All rights reserved.

Welcome to Our New Executive Director

Anita Turlington joined the FirstPoint Management Resources team in June 2014 as an Associate Account Manager. Anita graduated magna cum laude with a B.S. degree in Education from East Carolina University, concentrating in adult and vocational learning. She previously served as Products Manager for a medical association and brings extensive knowledge in many areas of association management: membership; committees; sales and marketing; customer service; continuing education; event planning and exhibiting; and website design. Anita has also served in other capacities in the non-profit arena, from facilities management of a hospital to the development and day-to day-operation of a foundation providing financial assistance to the families of children with life threatening illnesses. She has been a North Carolinian all her life and presently resides in Clayton with her two children. Please be sure to meet her while in Charleston!

Anita Turlington joined the FirstPoint Management Resources team in June 2014 as an Associate Account Manager. Anita graduated magna cum laude with a B.S. degree in Education from East Carolina University, concentrating in adult and vocational learning. She previously served as Products Manager for a medical association and brings extensive knowledge in many areas of association management: membership; committees; sales and marketing; customer service; continuing education; event planning and exhibiting; and website design. Anita has also served in other capacities in the non-profit arena, from facilities management of a hospital to the development and day-to day-operation of a foundation providing financial assistance to the families of children with life threatening illnesses. She has been a North Carolinian all her life and presently resides in Clayton with her two children. Please be sure to meet her while in Charleston!

From The Editor

Thank you to all the contributors throughout this year. I look forward to seeing everyone in Charleston!

Copyright ©2014 North Carolina Land Title Association